First TD in real estate stands for “First Trust Deed.” It is a legal document used in property transactions. This document secures a loan by using the property as collateral. The lender holds the deed until the borrower repays the loan.

Imagine securing a property loan with strong protection. That’s what First TD offers. It gives lenders confidence that their investment is safe. But what does this mean for borrowers?

In real estate, a First TD holds the primary claim on the property. If the borrower defaults, the lender can foreclose on the property. This makes First TDs a crucial part of real estate financing. They are commonly used in the real estate market.

The Basics of Real Estate Financing

Real estate financing is about getting money to buy property. People often need loans to help them buy homes or buildings. A lender gives the money, and the borrower agrees to pay it back over time. The loan is secured by the property, which means the lender can take the property if the borrower doesn’t pay.

There are different types of loans in real estate. The most common is a mortgage. A mortgage helps people buy homes by spreading payments over many years. Another type is a home equity loan, which lets people borrow money using their home’s value. Real estate financing makes it possible for people to own property, even if they don’t have all the money upfront.

Importance of First TD in Real Estate Transactions

First TD is very important in real estate transactions. It gives the lender the first claim on the property. If the borrower doesn’t pay the loan, the lender can take the property. This makes the loan safer for the lender. The lender feels more secure knowing they can get the property if something goes wrong.

First TD also helps the borrower. It makes the loan process smoother. The lender might offer better loan terms because they have more protection. This can mean lower interest rates or easier payments. Having a First TD in place is a key part of making real estate deals work well for everyone involved.

Examples of First TD in Action

Imagine someone wants to buy a house but doesn’t have enough money. They ask a bank for a loan. The bank agrees, but they want to make sure they will get their money back. So, they use a First TD. This means if the person can’t pay the loan, the bank can take the house. This protects the bank.

In another example, a business wants to buy a new office building. They also need a loan. The lender gives them the money but uses a First TD to secure the loan. If the business can’t pay, the lender can take the building. This helps the lender feel safe lending a large amount of money.

Finally, sometimes a homeowner needs extra money and gets a second loan. The first loan has a First TD, so it’s paid off first if there’s a problem. The second loan is riskier because it’s paid after the First TD. This shows how important First TD is in protecting lenders in real estate.

- Related Post” Child Tax Credit 2024 Payments

How First TD Affects Real Estate Investment Strategies

First TD plays a big role in real estate investment strategies. Investors often use loans to buy properties. First TD gives lenders the first claim on the property if the investor can’t pay back the loan. This makes the lender feel safer and more willing to lend money for the investment.

Investors must think carefully about First TD when planning their strategies. Since the lender has the first claim, the investor knows the loan is protected. This can help the investor get better loan terms, like lower interest rates. These better terms can make the investment more profitable.

First TD also affects how investors handle risks. They know the lender is protected, so they might be more confident in taking on bigger projects. However, they must always remember that if they can’t pay the loan, the lender can take the property. This makes First TD an important part of planning and managing real estate investments.

Potential Risks and Considerations

When dealing with First TD in real estate, there are some potential risks to consider. If a borrower cannot repay the loan, the lender can take the property. This is called foreclosure. Foreclosure can cause the borrower to lose their home or investment. It is important for borrowers to understand this risk before agreeing to a First TD.

Another risk is market fluctuations. The value of real estate can go up or down. If the property value drops, the Loan-to-Value (LTV) ratio can become higher. This means the borrower might owe more on the loan than the property is worth. This situation can make it harder to sell the property or refinance the loan.

Borrowers should also consider the legal fees and costs associated with a foreclosure process. If a foreclosure happens, there could be extra expenses like legal fees and property maintenance costs. These costs can add up and make the situation even more difficult. Understanding these risks and considering them carefully is important in real estate financing.

Benefits of First TD in Real Estate

First TD in real estate offers important benefits for lenders and borrowers. For lenders, First TD provides security. If the borrower cannot repay the loan, the lender can take the property through foreclosure. This makes lenders feel safer when giving out loans, knowing their money is protected.

For borrowers, First TD can lead to better loan terms. Because the lender feels secure, they might offer lower interest rates or more flexible payment options. This makes it easier and more affordable for borrowers to purchase property. Overall, First TD helps make real estate transactions smoother and more reliable for everyone involved.

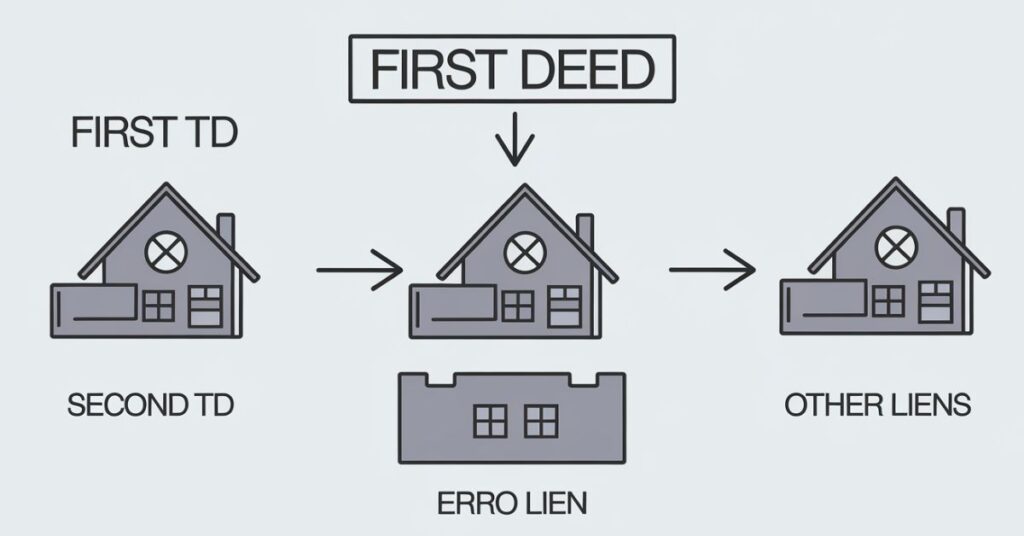

How First TD Differs from Second TD and Other Liens

First TD differs from Second TD and other liens in real estate. First TD has the highest priority. This means if the borrower cannot pay the loan, the lender with the First TD gets paid first. The property can be sold to cover the debt. This makes First TD safer for the lender.

Second TD and other liens have lower priority. If the property is sold, these lenders get paid after the First TD lender. This makes Second TD and other liens riskier. If the property’s value isn’t enough to cover all the debts, these lenders might not get paid in full. Understanding these differences is important in real estate financing.

- Related Post” Launching a Thriving Property Management Empire

Chris Leito Real Estate Fort Worth

Chris Leito is a real estate expert in Fort Worth. He helps people buy and sell homes in the area. With his knowledge of the Fort Worth real estate market, Chris Leito provides guidance to clients. He makes the process of finding the right home easier.

Chris Leito also assists with real estate investments in Fort Worth. He understands the market and helps clients make smart decisions. Whether buying a home or investing, Chris Leito’s experience ensures clients get the best deals. His work in Fort Worth real estate is trusted and respected.

LOI Template for Real Estate Purchase in Nevada

An LOI template for real estate purchase in Nevada is a helpful tool. LOI stands for Letter of Intent. This document outlines the basic terms of a property deal before the final agreement is made. It helps both the buyer and seller understand the key points of the deal.

The LOI template includes important details like the price, payment terms, and deadlines. It also covers any special conditions the buyer or seller may have. Using an LOI template makes sure that both parties agree on the main parts of the deal before moving forward.

In Nevada, having a clear LOI is important because it sets the stage for the final contract. It helps avoid misunderstandings and keeps the process smooth. This template is a valuable guide for anyone looking to buy or sell real estate in Nevada.

Dalaguete Real Estate Tax Rate

Dalaguete has specific rules for real estate taxes. Property owners in Dalaguete must pay a tax based on their property’s value. The local government uses this money to fund community services and infrastructure. Knowing the tax rate helps property owners understand how much they need to pay each year.

The real estate tax rate in Dalaguete is set by local officials and can change over time. Property owners receive a tax bill that shows how much they owe. Paying these taxes on time is important to avoid extra fees or legal issues. Understanding the tax rate helps property owners manage their finances better.

Frequently Asked Question

What is a first trust loan?

A first trust loan, also known as a first trust deed loan, is a mortgage secured by a property, giving the lender the primary claim in case of default. It has top priority over other loans or liens on the property.

What is the meaning of trust deed?

A trust deed is a legal document that secures a loan by transferring property ownership to a trustee until the borrower repays the loan. It outlines the terms and conditions of the loan and protects the lender’s interest.

How to get a trust deed?

To get a trust deed, you need to work with a lender who offers trust deed loans. The lender will prepare the trust deed document, and you must sign it to secure the loan against your property.

What is the difference between a trust and a trust deed?

A trust is a legal arrangement where a trustee holds and manages assets for beneficiaries. A trust deed, on the other hand, is a specific document used in real estate to secure a loan, transferring property ownership to a trustee until the loan is repaid. In essence, a trust is a broader concept for managing assets, while a trust deed is a tool used for securing real estate loans.

Conclusion

In real estate, the First TD stands for “First Trust Deed.” It is a crucial document that helps secure a loan by using the property as collateral. The lender holds this deed until the borrower repays the loan. If the borrower cannot pay, the lender can take the property through foreclosure. This makes the First TD important for protecting the lender’s investment.

Understanding “What is the First TD in Real Estate?” is essential for anyone involved in buying or selling property. It ensures that both the lender and borrower know their rights and responsibilities. The First TD helps make real estate transactions smoother and more secure for everyone involved.

Hey, Molar is the voice behind this all-encompassing blog, sharing expert insights and practical advice on business, real estate, and more. Dedicated to helping you navigate the complexities of these fields, Kelly provides the latest trends, in-depth analyses, and creative strategies to elevate your ventures.