Telekom FintechAsianet is a leading player in the financial technology sector. It provides cutting-edge digital banking services across Asia and the USA. Their focus is on delivering innovative payment solutions and secure data analytics tools.

In this “Telekom FintechAsianet: A Comprehensive Guide,” we explore the company’s key offerings. You will learn how their services are shaping the future of finance. Discover why they are a trusted name in fintech.

Telekom FintechAsianet has been at the forefront of digital transformation. They specialize in AI, machine learning, and blockchain technology. Their commitment to financial inclusion and regulatory compliance is unmatched.

Understanding Telekom FintechAsianet

Telekom FintechAsianet is a company that focuses on improving financial technology. They work in Asia and the USA to help people and businesses with digital banking services. Their goal is to make payments easier and more secure by using advanced tools like AI, machine learning, and blockchain technology.

These tools help protect data and make financial transactions faster and safer. Telekom FintechAsianet also cares about financial inclusion, which means they want everyone to have access to financial services, no matter where they live.

The company follows strict rules to ensure that their services are safe and reliable. They are known for their commitment to digital transformation, which is the process of using technology to improve how businesses operate.

Telekom FintechAsianet helps create a more connected world by offering innovative solutions that meet the needs of today’s financial landscape. Their work helps people and businesses manage money more effectively, making financial services easier to use for everyone. This dedication to improving financial technology makes Telekom FintechAsianet an important player in the global market.

Key Features and Services of Telekom FintechAsianet

Telekom FintechAsianet offers a range of key features and services designed to enhance financial transactions. Their solutions include advanced digital banking, secure payment processing, and innovative data analytics. They also focus on integrating AI and blockchain technology to improve security and efficiency.

Digital Banking Services

Digital banking services are ways to manage your money using technology. Instead of going to a bank branch, you can use a computer or smartphone to handle your finances. This means you can check your account balance, transfer money, and pay bills online. It is easy and convenient because you can do everything from home or anywhere with an internet connection.

Telekom FintechAsianet provides digital banking services that help people manage their money more easily. They offer secure and user-friendly platforms for checking accounts, making payments, and even saving money.

Their services use advanced technology to keep your information safe and to make transactions quick. By using these services, people can save time and avoid the hassle of visiting a bank in person. Digital banking from Telekom FintechAsianet makes managing finances simple and efficient.

Payment Solutions

Payment solutions help people send and receive money easily. They allow you to make payments using different methods like credit cards, debit cards, or online transfers. Instead of carrying cash, you can use your phone or computer to pay for things. This makes buying and selling goods and services faster and more convenient.

Telekom FintechAsianet offers advanced payment solutions that make handling money simple and safe. Their technology ensures that transactions are secure and quick. With their payment solutions, businesses and individuals can manage payments without worrying about security.

Telekom FintechAsianet also provides tools that help track spending and handle multiple types of payments. This way, people can use a single platform to manage all their financial transactions. Their payment solutions make everyday financial activities easier and more reliable.

- Related Blog” How to Access the Localhost Server at 127.0.0.1:57573

Data Analytics and AI

Data analytics and AI help us understand and use information better. Data analytics involves looking at large amounts of data to find useful patterns and insights. This helps businesses make smart decisions based on the information they have. For example, data analytics can show which products are popular or help predict future trends.

AI, or artificial intelligence, is a technology that can learn from data and make decisions on its own. It works like a smart computer that can understand and process information quickly. Telekom FintechAsianet uses AI and data analytics to improve their services.

They analyze data to ensure their systems are running smoothly and to spot any problems before they happen. AI helps them provide better and more personalized services by predicting what customers might need. Together, data analytics and AI make financial services more efficient and secure, helping people and businesses manage their money better.

Blockchain Solutions

Telekom FintechAsianet uses blockchain technology to make financial transactions more secure. When money is transferred or records are updated, blockchain keeps a permanent and unchangeable record of these actions.

This helps prevent fraud and ensures that all transactions are accurate. With blockchain, people can trust that their financial information is safe and that their transactions are processed correctly. Telekom FintechAsianet’s use of blockchain technology makes their services reliable and trustworthy for managing and tracking money.

Risk Management Tools

Telekom FintechAsianet offers advanced risk management tools to keep their services safe. These tools help monitor and identify any potential risks in financial transactions or data security. If a problem is detected, the tools alert the company so they can take action quickly.

This helps ensure that the money and information of their customers are secure. Telekom FintechAsianet’s risk management tools make sure that their financial services are reliable and that any risks are managed effectively. This way, users can trust that their financial activities are safe and well-protected.

- Related Blog” Prince Narula Digital PayPal

The Role of Technology in Telekom FintechAsianet’s Success

Technology plays a big part in Telekom FintechAsianet’s success. They use different types of technology to make their financial services better. For example, they use computers and software to handle transactions quickly and safely. This technology helps them provide reliable services to their customers. Without technology, it would be much harder to manage all the data and transactions efficiently.

Telekom FintechAsianet also uses advanced tools like artificial intelligence and blockchain to improve their services. Artificial intelligence helps them analyze data and make smart decisions. Blockchain ensures that transactions are secure and cannot be tampered with. These technologies make their services more trustworthy and user-friendly. By using the latest technology, Telekom FintechAsianet stays ahead in the financial industry and offers top-quality services to people and businesses. Technology is a key factor in their continued success and growth.

Telekom FintechAsianet’s Role in Driving Innovation in the Region

Telekom FintechAsianet plays a key role in driving innovation in their region. They use advanced technology to improve financial services and make them more accessible. By introducing new tools like digital banking and secure payment systems, they help businesses and people manage their money better. Their innovative solutions make financial activities easier and more efficient for everyone.

In addition, Telekom FintechAsianet supports the growth of technology in their region. They bring new ideas and technologies to the area, which helps other companies and industries develop as well.

Their work with artificial intelligence, blockchain, and data analytics sets a high standard for what technology can do. This encourages other businesses to also invest in new technologies and improve their services. Telekom FintechAsianet’s efforts drive progress and help shape the future of financial technology in the region.

Telekom FintechAsianet’s Approach to Financial Inclusion

Telekom FintechAsianet is dedicated to making financial services available to everyone. They focus on financial inclusion, which means making sure that people from all backgrounds have access to banking and money management tools. They work to provide services that are easy to use, even for people who may not have much experience with technology. This helps ensure that everyone can manage their money effectively.

To support financial inclusion, Telekom FintechAsianet offers various services designed for different needs. They provide digital banking solutions that are simple and accessible, helping people who may not have access to traditional banks.

Their payment systems are designed to be secure and easy to use, making financial transactions smooth for everyone. By offering these services, Telekom FintechAsianet helps more people take part in the financial system and improve their financial well-being. Their approach to financial inclusion ensures that no one is left out and that everyone has the tools they need to succeed.

Ensuring Compliance and Security in Financial Services

Ensuring compliance and security in financial services is very important. Compliance means following the rules and laws that apply to financial activities. Security means protecting money and information from being stolen or misused. Telekom FintechAsianet takes these matters seriously to keep their services safe and reliable. They use strict rules and advanced technology to make sure they follow all regulations and protect customer data.

To ensure security, Telekom FintechAsianet uses special tools and techniques. They use encryption, which is a way to keep information private and secure. Their systems are regularly checked to find and fix any security issues. They also make sure that all transactions are monitored to prevent any fraudulent activities.

By focusing on compliance and security, Telekom FintechAsianet helps build trust with their customers. They work hard to make sure that everyone’s money and personal information are kept safe and secure. This commitment to security and following the rules helps them provide reliable financial services that people can trust.

Analyzing the Impact of Telekom FintechAsianet on the Asian Financial Market

Telekom FintechAsianet has made a big impact on the Asian financial market. They bring new technology and services that help improve how people and businesses handle money. By offering advanced digital banking and secure payment systems, they make financial transactions easier and safer. Their innovative tools help people manage their finances more effectively, which benefits the whole market.

Their work also encourages other companies to adopt new technologies and improve their services. When Telekom FintechAsianet introduces new ideas, it sets a high standard for the financial industry.

This inspires other businesses to innovate and offer better services. As a result, the entire Asian financial market becomes more modern and efficient. Telekom FintechAsianet’s influence helps drive progress and growth in the region, making financial services better for everyone involved.

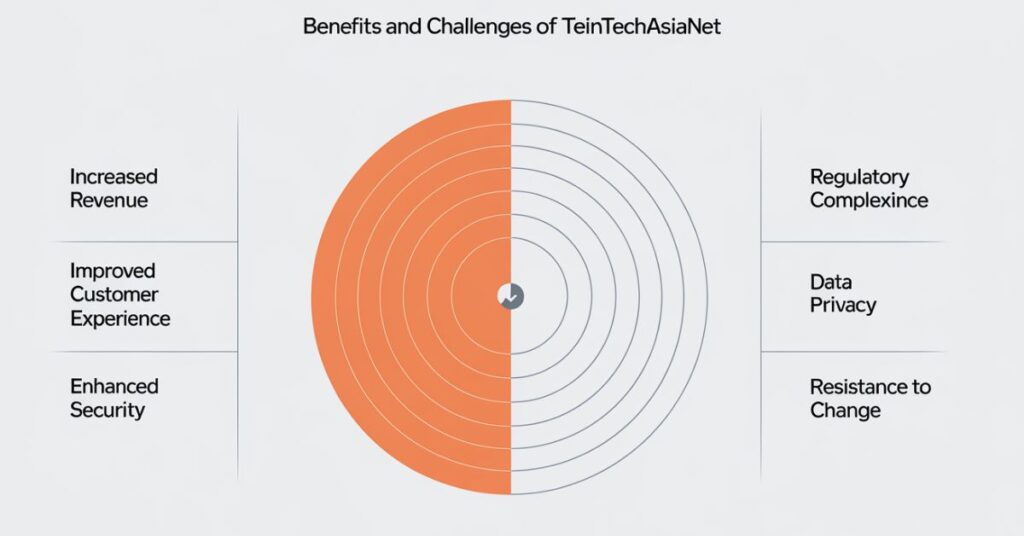

Benefits and Challenges of Telekom FintechAsianet

Telekom FintechAsianet offers many benefits to its users. One big benefit is that they make managing money easier with their digital banking and payment solutions. People can handle their finances quickly from their phones or computers, without needing to visit a bank. Their technology also helps keep transactions safe and secure, which is very important for protecting personal information.

However, there are also some challenges. Technology can sometimes have problems, like glitches or outages, which might affect services. Some people might find new technology hard to use or understand at first.

Telekom FintechAsianet works hard to fix these issues and make their services better. They continue to improve their technology to offer the best experience possible. Despite these challenges, Telekom FintechAsianet’s efforts bring many advantages to people and businesses, making financial tasks easier and more secure.

Future Trends and Predictions for Telekom FintechAsianet

Telekom FintechAsianet is likely to see many exciting changes in the future. One trend is the increased use of advanced technology like artificial intelligence and blockchain. These technologies will make financial services even more efficient and secure. For example, AI can help predict financial trends and improve customer service, while blockchain ensures safe and transparent transactions.

Another trend is the growth of digital banking and mobile payments. More people will use their phones and computers for banking and payments, making it easier to manage money from anywhere. Telekom FintechAsianet will continue to develop new tools and services to keep up with these changes.

They will focus on making their technology even better and more accessible to a wider audience. As technology evolves, Telekom FintechAsianet will stay at the forefront, offering innovative solutions to meet the needs of their customers. This focus on future trends will help them remain a leader in the financial technology industry.

The Road Ahead: Predictions for Telekom FintechAsianet

Telekom FintechAsianet is set for an exciting future. They will likely continue to use advanced technologies like artificial intelligence and blockchain to improve their services. These technologies will help them offer even better financial solutions and keep transactions secure. With AI, they can predict trends and personalize services for their users. Blockchain will ensure that all transactions are safe and transparent.

In the coming years, more people will use digital and mobile banking. Telekom FintechAsianet will focus on making their digital tools easier to use and more accessible. They will work to expand their services to reach more people across Asia. By staying updated with the latest technology and trends, Telekom FintechAsianet will keep leading in the financial technology industry. Their efforts will help improve financial services for everyone and support their growth as a top player in the market.

Frequently Asked Question

What is Telekom FintechAsianet?

Telekom FintechAsianet is a company that provides advanced financial technology services, including digital banking and payment solutions. They use cutting-edge tools like artificial intelligence and blockchain to improve financial transactions and security.

What is the future outlook for Telekom FintechAsianet?

The future outlook for Telekom FintechAsianet is promising, with expected growth driven by advances in artificial intelligence and blockchain technology. They will continue to expand digital banking and mobile payment services to meet evolving customer needs.

Which services does Telekom FintechAsianet provide?

Telekom FintechAsianet provides digital banking services, secure payment solutions, and advanced financial technology tools. Their offerings include mobile banking, online transactions, and innovative financial management solutions.

What makes Telekom FintechAsianet stand out in the fintech industry?

Telekom FintechAsianet stands out for its use of cutting-edge technologies like artificial intelligence and blockchain, which enhance security and efficiency. Their focus on expanding digital banking and payment solutions sets them apart in the fintech industry.

Conclusion

In summary, “Telekom FintechAsianet: A Comprehensive Guide” shows how this company is leading in the financial technology world. They use advanced tools like artificial intelligence and blockchain to make banking and payments safer and more efficient. Their focus on digital services helps people manage their money easily and securely.

Looking ahead, Telekom FintechAsianet will continue to grow and offer innovative solutions. They will keep improving their technology to meet the needs of their users. By staying at the forefront of fintech trends, they will help shape the future of financial services in Asia and beyond.

Hey, Molar is the voice behind this all-encompassing blog, sharing expert insights and practical advice on business, real estate, and more. Dedicated to helping you navigate the complexities of these fields, Kelly provides the latest trends, in-depth analyses, and creative strategies to elevate your ventures.