Planning for retirement is one of the most important financial steps you can take in life. So, what is the main reason you should start saving for retirement as early as possible? The answer lies in the power of compound interest, which helps your savings grow over time. This article will discuss strategies to maximize your savings and ensure a comfortable retirement.

Start Early to Take Advantage of Compound Interest

The earlier you start saving for retirement, the more time your money has to grow. Compound interest allows your savings to generate earnings, which are reinvested to generate even more. This snowball effect can significantly increase your retirement fund over time, making it crucial to start saving as soon as possible.

Even small contributions can grow into a substantial nest egg by starting early. It’s important to prioritize saving, even if you can only contribute a small amount at first. Over the years, consistent contributions and the power of compounding can lead to a much larger retirement fund than expected.

SoFi states, “Investments — including investments in retirement plans, such as an employee-sponsored 401(k) plan or a traditional or Roth IRA — likewise benefit from compounding returns. Over time, you can see returns on both the principal as well as the returns on your contributions.”

Set Clear Retirement Goals

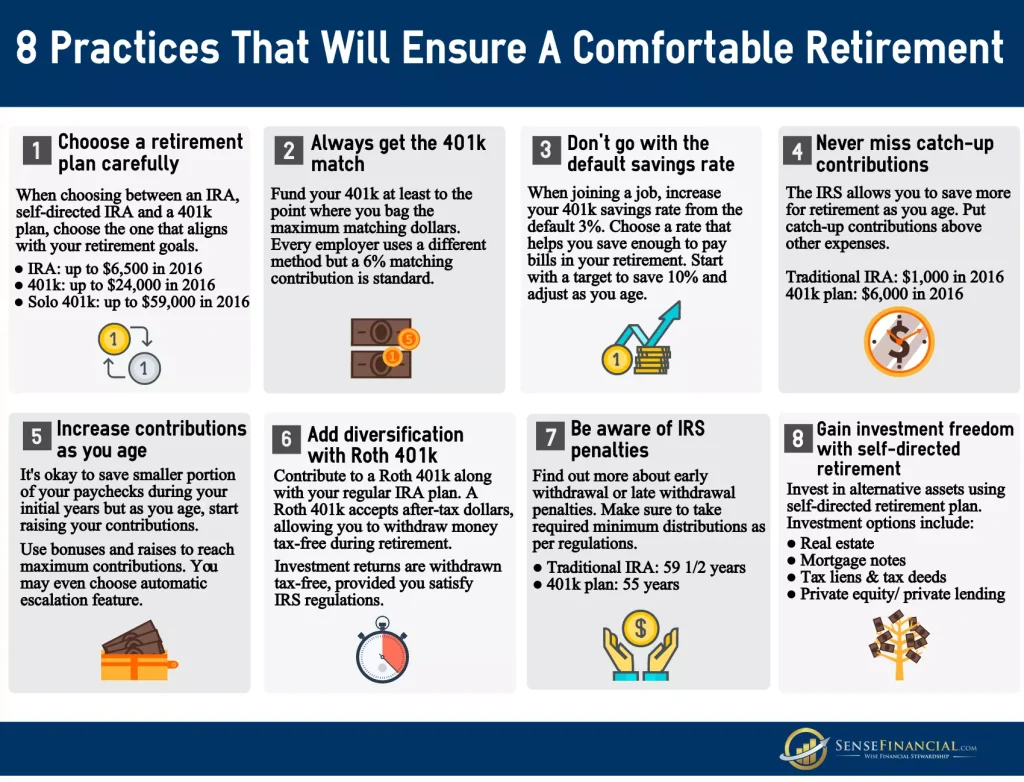

To maximize your savings, setting clear and realistic retirement goals is essential. Consider the lifestyle you want to maintain during retirement and estimate how much money you’ll need to support it. This will help you determine how much you should save each month and what types of investments will best help you reach your goals.

Having clear goals provides direction and motivation. It’s easier to save consistently when you know exactly what you’re working toward. Regularly reviewing and adjusting your goals can also keep you on track, ensuring that your retirement savings plan remains aligned with your future needs.

Diversify Your Investments

Diversifying your investments is a key strategy for maximizing your retirement savings. By spreading your money across different types of assets, such as stocks, bonds, and real estate, you can reduce risk and increase the growth potential. A well-diversified portfolio helps protect your savings from market volatility while still allowing for significant growth over time.

When planning your retirement investments, consider your risk tolerance and time horizon. Younger individuals can typically afford to take on more risk as they have more time to recover from market downturns. As you approach retirement, it’s wise to shift to more conservative investments to protect your savings gradually.

Take Full Advantage of Employer Contributions

If your employer offers a retirement savings plan with matching contributions, taking full advantage of this benefit is essential. Employer matches are essentially free money that can significantly boost your retirement savings. Ensure you contribute enough to your retirement account to receive the maximum match from your employer.

Not taking advantage of employer contributions is like leaving money on the table. By maximizing these contributions, you can quickly grow your retirement fund and ensure a more comfortable retirement. Even if you have other financial priorities, contributing enough to get the full match should be a top priority.

Regularly Review and Adjust Your Savings Plan

Your financial situation and retirement goals may change over time, so it’s important to review and adjust your savings plan regularly. Life events such as marriage, having children, or changes in income can impact your ability to save and may require adjustments to your retirement strategy.

Regular reviews help you stay on track and ensure that your savings plan remains relevant to your current circumstances. By making necessary adjustments, such as increasing your contributions or changing your investment strategy, you can continue to work toward your retirement goals and maximize your savings.

Maximizing your savings for a comfortable retirement requires starting early, setting clear goals, diversifying your investments, taking advantage of employer contributions, and regularly reviewing your plan. Following these strategies can build a strong financial foundation and enjoy a secure and fulfilling retirement. Start planning today to ensure a bright financial future.

Hey, Molar is the voice behind this all-encompassing blog, sharing expert insights and practical advice on business, real estate, and more. Dedicated to helping you navigate the complexities of these fields, Kelly provides the latest trends, in-depth analyses, and creative strategies to elevate your ventures.