Understanding converting an annual salary into a monthly income is essential for effective budgeting and financial planning. Knowing monthly income helps individuals better manage their finances and plan for short-term and long-term goals. This article will explain the process of breaking down an annual salary into a monthly figure, making it easier to navigate everyday financial decisions.

Step-by-Step Guide on How to Calculate Monthly Income

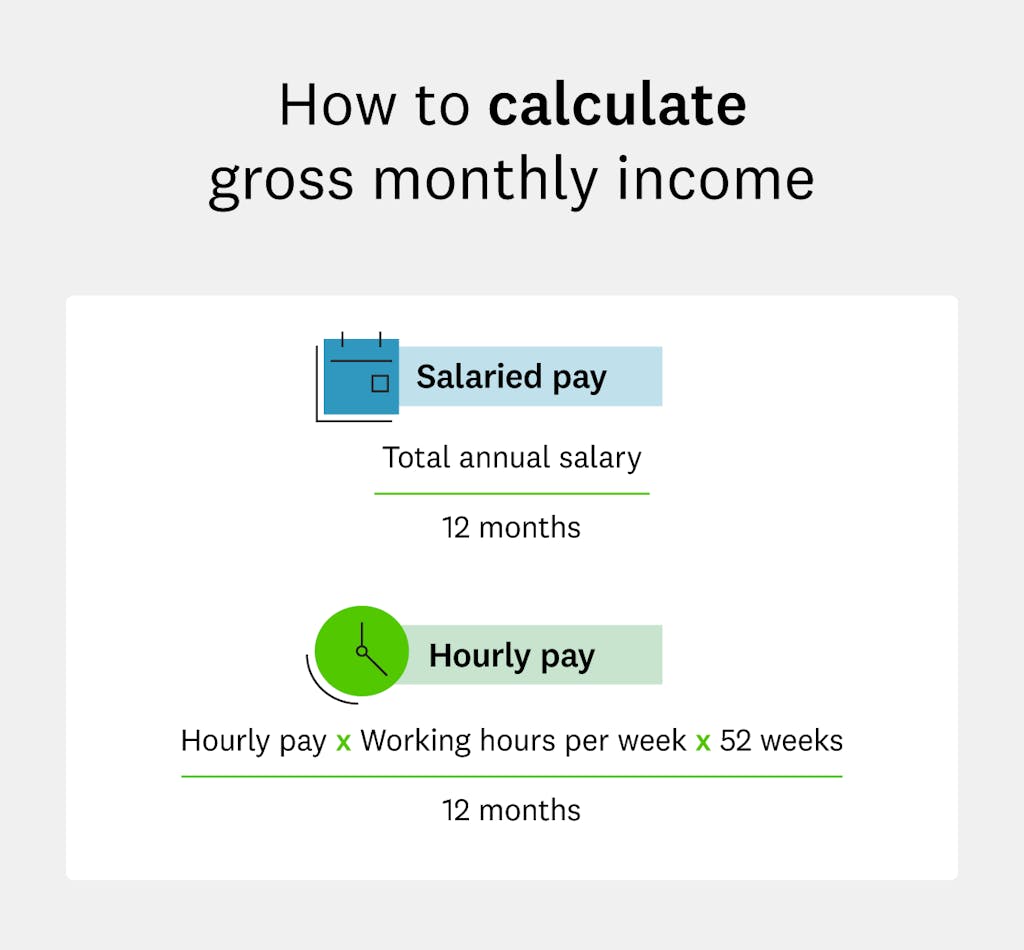

The process for accurately determining monthly earnings from an annual salary is simple. First, find how to calculate monthly income by dividing the annual salary by 12, as there are 12 months in a year. This straightforward calculation gives the base monthly income before taxes and deductions.

For example, if a person’s annual salary is $60,000, the monthly income would be $60,000 divided by 12, resulting in $5,000. However, it’s important to note that this figure represents gross income, meaning taxes and other deductions have not yet been applied. This method provides a general estimate for initial budgeting purposes.

Accounting for Deductions and Taxes

Once the gross monthly income is determined, it’s crucial to account for deductions such as taxes, healthcare, and retirement contributions. These deductions reduce the take-home pay, also known as net income, which is the amount available for spending each month.

Individuals should subtract taxes and other deductions from the gross monthly figure to calculate net monthly income. For example, if the gross monthly income is $5,000 but taxes and other deductions amount to $1,000, the net income would be $4,000. This figure reflects the actual money available for monthly expenses.

SoFi notes the importance of correctly calculating one’s gross monthly income to get your true take-home income. “It is essential to accurately calculate gross monthly income to make informed financial decisions.”

Including Bonuses or Additional Income

Some jobs offer bonuses or commission-based earnings, which can affect monthly income. While the base salary may be consistent, additional bonus earnings can fluctuate throughout the year. Including this additional income when calculating monthly earnings is helpful for long-term financial planning.

To factor in bonuses or other additional income, divide the total amount earned from these sources over a year by 12. Individuals can create a more accurate financial plan by including all forms of income.

Considering Pre-Tax vs. Post-Tax Income

Another important consideration is using pre-tax or post-tax income when calculating monthly earnings. Pre-tax income refers to the gross amount before any taxes are deducted, while post-tax income reflects the amount after taxes are taken out.

Knowing both figures can be beneficial when planning for future expenses or savings. Pre-tax income provides a broader view of total earnings, while post-tax income is more relevant for daily budgeting and spending. Deciding which figure to use depends on the specific financial goals, such as saving for retirement or covering monthly expenses.

Using Monthly Income for Budgeting and Saving

Calculating monthly income is essential for effective budgeting. By understanding how much money is available each month, individuals can allocate funds for housing, utilities, groceries, and savings. This helps avoid overspending and ensures that financial goals are met.

Creating a budget based on monthly income allows for better control over spending habits and helps build savings for the future. Whether planning for a vacation, paying off debt, or investing in long-term goals, having a clear picture of monthly earnings simplifies financial planning.

Converting an annual salary into monthly income is a straightforward process that offers valuable insight into personal finances. Individuals can accurately determine their monthly income by following simple calculations, accounting for deductions, and including additional earnings. Understanding monthly income is key to managing money more effectively and planning for a secure financial future.

Hey, Molar is the voice behind this all-encompassing blog, sharing expert insights and practical advice on business, real estate, and more. Dedicated to helping you navigate the complexities of these fields, Kelly provides the latest trends, in-depth analyses, and creative strategies to elevate your ventures.