If you’ve ever glanced at your bank statement only to be met with a string of perplexing codes like “DR ADJ REDIST CADV PRIN,” you’re not alone.

These cryptic codes can leave even the savviest of consumers scratching their heads. But fear not! In this comprehensive guide, we’ll discuss the depths of these enigmatic charges, unlocking their mystery one code at a time.

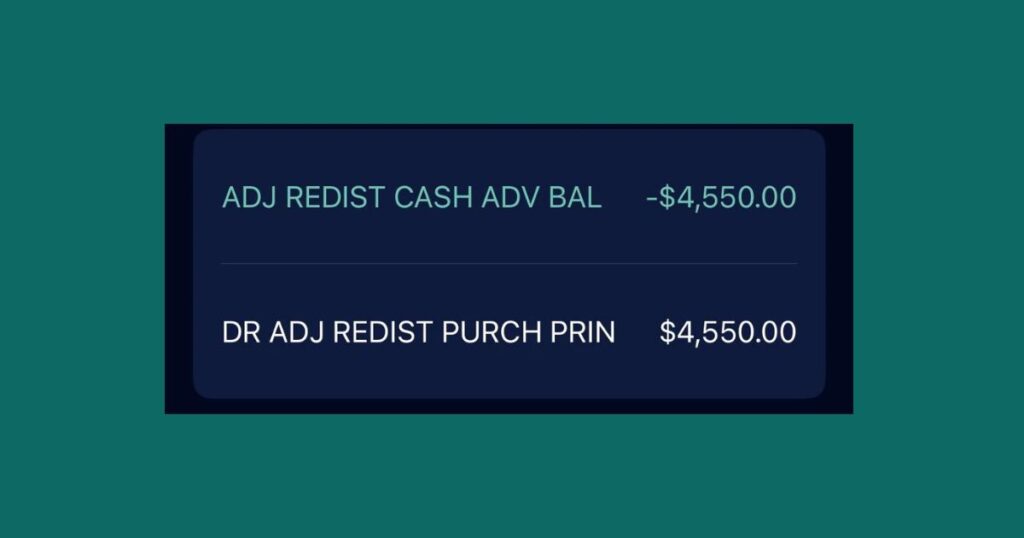

What is ADJ REDIST Purchase Bal Charge?

Let’s start by deciphering the code itself. “ADJ REDIST Purchase Bal” is a charge commonly associated with American Express (AMEX) statements.

But what does it actually mean? In simple terms, this charge represents an internal adjustment made by AMEX to realign account balances.

Picture it as a financial housekeeping task—ensuring that the numbers on your statement accurately reflect your financial reality.

Understanding the Components:

- ADJ: Short for “Adjustment,” indicating a corrective action.

- REDIST: Abbreviation for “Redistribution,” suggesting a reshuffling of funds.

- Purchase Bal: Denoting the purchase balance, the amount owed for recent transactions.

What is the Purpose of DR ADJ REDIST CADV PRIN Charge Adjustments?

Now that we’ve demystified the code, let’s explore why these adjustments are necessary. The primary purpose of DR ADJ REDIST CADV PRIN charges is to maintain financial accuracy and transparency within your account.

Key Objectives of Adjustments:

- Accounting Accuracy: By rectifying any discrepancies, adjustments uphold the integrity of your financial records.

- Actual Liability Management: Ensuring that your account balance accurately reflects your financial position.

- Transparency: Providing a clear and coherent overview of your transactions.

- Facilitating Smoother Transactions: Minimizing disruptions caused by processing errors.

In essence, these adjustments serve as guardians of financial truth, diligently ensuring that your account remains in tip-top shape.

Recommended Blog: Jackson Asbestos Legal Questions: Answers And Advice

Does This Charge Have an Impact on Account Balance?

You might be wondering whether these adjustments affect your bottom line. The answer is no—DR ADJ REDIST CADV PRIN charges typically have a neutral net impact on your account balance.

Instead, they serve as internal maneuvers orchestrated by AMEX to fine-tune your account’s financial equilibrium.

Addressing Merchant Details and Placeholders:

Incomplete merchant details can sometimes lead to placeholder entries like “AMERICAN EXPRESS INTERNAL TRANSACTION” appearing on your statement.

These placeholders serve as temporary markers while transaction details are being finalized. Rest assured, once confirmed, the correct merchant’s name will replace these placeholders.

Contact Information for Queries:

If you find yourself still grappling with the intricacies of these charges, don’t hesitate to reach out to American Express for clarification.

You can contact them via phone, mail, or their website. Additionally, if you spot any discrepancies in merchant names, AMEX’s customer service team is readily available to assist you.

The Premium Perspective:

It’s worth noting that these adjustments are particularly prevalent on American Express Platinum cards.

This premium product, with its array of services and benefits, necessitates frequent reconciliations to uphold its esteemed status.

Account Adjustments as AMEX Internal Transactions

Delving deeper into the realm of AMEX’s internal workings, it’s crucial to understand the significance of these adjustments within their transactional processes.

Internal Adjustment Dynamics:

AMEX statements encompass a spectrum of adjustments aimed at fine-tuning account balances.

These adjustments, distinct from standard journal entries, play a pivotal role in maintaining financial accuracy.

Recommended Blog: WHAT IS THE INFINITE LOOP CHARGE ON YOUR BANK STATEMENT?

FAQs – Frequently Asked Questions

What is the Difference Between DR ADJ and DR ADJ Redist CADV PRIN?

While both codes signify adjustments, they may vary in their specific purposes and implications. “DR ADJ” typically denotes a general adjustment, whereas “DR ADJ REDIST CADV PRIN” encompasses a more detailed adjustment involving redistribution and card activity verification, among other elements.

What is the Difference Between a Credit and Debit Adjustment in the AMEX Statement?

In the realm of AMEX statements, credit adjustments decrease the balance owed, whereas debit adjustments increase it. These adjustments serve to reconcile account balances and ensure financial accuracy.

Why Would You Dispute a Charge on American Express?

Disputing a charge on American Express is warranted in cases of suspected errors or unauthorized transactions. Prompt action is crucial to safeguarding your financial interests and rectifying any discrepancies swiftly.

How Long Does Amex Give You to Dispute a Charge?

American Express typically provides a window of time within which customers can dispute charges. It’s imperative to familiarize yourself with the specific timeframe outlined by AMEX and take prompt action if needed.

How Do I Dispute Goods Not Received on American Express?

If you’ve encountered an issue where goods have not been received despite payment, you can initiate a dispute with American Express. This involves providing documentation and details regarding the transaction in question, enabling AMEX to investigate and resolve the issue effectively.

Conclusion

In concluding our exploration of “DR ADJ REDIST CADV PRIN Charges,” we’ve successfully peeled back the layers of complexity surrounding these enigmatic codes, shedding light on their true nature and purpose.

Armed with a deeper understanding of these adjustments, we can approach our financial statements with confidence, knowing that behind every cryptic code lies a meticulous effort to maintain accuracy and transparency in our financial dealings.

So, the next time you encounter a DR ADJ REDIST CADV PRIN charge, rest assured that the mystery has been unraveled, and you hold the key to financial clarity.

Hey, Molar is the voice behind this all-encompassing blog, sharing expert insights and practical advice on business, real estate, and more. Dedicated to helping you navigate the complexities of these fields, Kelly provides the latest trends, in-depth analyses, and creative strategies to elevate your ventures.