If you’ve ever glanced at your bank statement and been met with the cryptic entry “ACHMA VISB PYMNT,” you’re not alone.

Many individuals find themselves puzzled by this unfamiliar notation, wondering what it signifies and why it’s there.

In this comprehensive guide, we’ll delve into the depths of ACHMA VISB PYMNT charges, unraveling their meaning, exploring their origins, and equipping you with the knowledge to manage them effectively.

What is ACHMA VISB BILL PYMNT on Your Bank Statement?

Let’s start by deciphering the enigmatic acronym: ACHMA VISB PYMNT. This combination of letters represents a transaction associated with Verizon Wireless services.

Specifically, “ACHMA” stands for Automated Clearing House (ACH) Merchant Authorization, while “VISB” indicates Visa bill payment. Therefore, when you see “ACHMA VISB BILL PYMNT” on your bank statement,

it signifies that you’ve utilized the ACH method to electronically transfer funds for payment, with a Visa card serving as the payment medium.

Understanding ACHMA VISB PYMNT

To grasp the essence of ACHMA VISB PYMNT, it’s essential to comprehend the underlying mechanisms.

The Automated Clearing House (ACH) facilitates electronic transfers of funds between bank accounts, offering a convenient and efficient payment solution.

Individuals and financial institutions alike leverage ACH services, utilizing them to move money seamlessly and securely.

In the context of Verizon Wireless, ACHMA VISB PYMNT denotes the utilization of this electronic payment system to settle bills and expenses associated with their services.

Why Does ACHMA VISB BILL PYMNT Appear on Your Bank Statement?

Now that we’ve demystified the acronym, let’s delve into why ACHMA VISB BILL PYMNT might appear on your bank statement.

Essentially, if you’re a Verizon Wireless customer, this charge is a natural consequence of using their services and opting for electronic payment methods.

The ACHMA VISB code signifies that your transaction was processed through the Automated Clearing House system and involved a Visa card for payment.

Seamless Payment Processing

Verizon Wireless offers customers the convenience of automatic bill payments, streamlining the process of settling monthly expenses.

By authorizing Verizon to withdraw funds electronically from your account, you ensure that your bills are paid on time without the hassle of manual intervention.

This automated system not only saves time but also reduces the risk of missed payments and late fees.

How Does ACHMA VISB BILL PYMNT Appear on Your Bank Statement?

Understanding how ACHMA VISB BILL PYMNT manifests on your bank statement sheds light on its visibility and significance.

When Verizon Wireless initiates an automatic payment transaction, it reflects as ACHMA VISB PYMNT on your statement.

This standardized notation serves as a clear indicator of the payment method and facilitates easy tracking of expenses related to Verizon services.

Recognizing ACHMA VISB PYMNT Entries

While the appearance of ACHMA VISB PYMNT on your bank statement might initially seem perplexing, it’s important to recognize its significance.

By familiarizing yourself with this notation, you can easily identify and reconcile transactions related to Verizon Wireless services, ensuring transparency and accuracy in your financial records.

How to Stop ACHMA VISB PYMNT

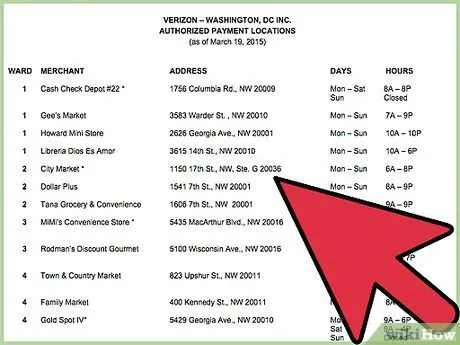

If you find yourself in a situation where ACHMA VISB PYMNT charges are appearing on your bank statement but you’re not a Verizon Wireless customer, it’s crucial to take action promptly.

Here are some steps you can take to address this issue and prevent further unauthorized charges:

1. Verify Your Account Activity

Begin by reviewing your recent account activity to confirm the presence of any unfamiliar charges, including those labeled as ACHMA VISB PYMNT.

Check your records and receipts to ensure that all transactions align with your legitimate expenses.

2. Contact Verizon Wireless

If you suspect unauthorized charges related to Verizon Wireless services, reach out to their customer support team immediately.

Inform them of the situation and provide details regarding the suspicious transactions appearing on your bank statement.

3. Secure Your Accounts

Take proactive measures to safeguard your financial accounts from unauthorized access.

Change passwords and enable additional security features such as two-factor authentication to prevent unauthorized individuals from gaining access to your accounts.

4. Dispute the Charges

Contact your bank or credit card issuer to dispute any unauthorized charges appearing on your statement.

Provide them with relevant information and documentation to support your claim, including details of the unauthorized transactions and your efforts to resolve the issue with Verizon Wireless.

5. Monitor Your Accounts

Remain vigilant and continue to monitor your bank statements and account activity regularly.

Report any suspicious or unauthorized transactions to your financial institution immediately and take appropriate action to address them.

6. Seek Legal Assistance if Necessary

If you encounter challenges in resolving the issue with Verizon Wireless or disputing the unauthorized charges with your bank, consider seeking legal assistance.

An attorney specializing in consumer protection or financial matters can provide guidance and advocate on your behalf.

Conclusion

In conclusion, ACHMA VISB PYMNT charges on your bank statement are associated with Verizon Wireless services and signify payments made through the Automated Clearing House (ACH) system using a Visa card.

While these charges are legitimate for Verizon Wireless customers, it’s essential to remain vigilant and address any unauthorized transactions promptly.

By understanding the origins and implications of ACHMA VISB PYMNT charges, you can effectively manage your finances and protect yourself from fraudulent activity.

Remember to review your account activity regularly, take swift action to dispute unauthorized charges, and utilize security measures to safeguard your accounts.

Hey, Molar is the voice behind this all-encompassing blog, sharing expert insights and practical advice on business, real estate, and more. Dedicated to helping you navigate the complexities of these fields, Kelly provides the latest trends, in-depth analyses, and creative strategies to elevate your ventures.